Deposits in Lebanese banks are expected to recover from a dip in the first five months of 2019 as customer optimism returns after approval of the state budget, the chairman of the Association of Banks in Lebanon said on Monday.

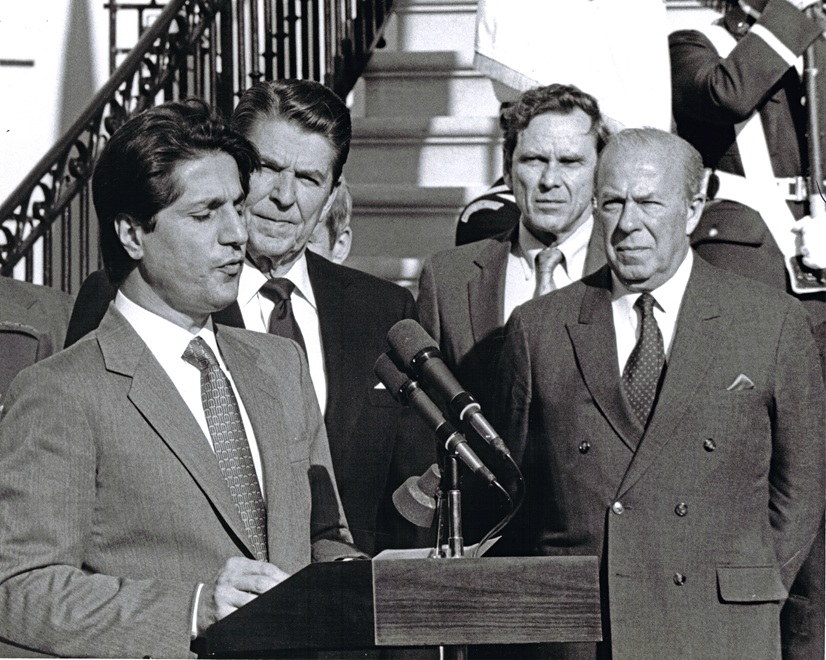

Salim Sfeir said deposits had fallen to $176 billion at the end of May from $179 billion at the end of December. “I expect a very positive recovery. Our market is very elastic,” he told Reuters in an interview.

He also said banks would take steps to support the economy in the next four to seven months, including working to reduce interest rates and to extend more loans to some sectors.

“The banks are liquid enough, the banks are optimistic that they will be able to give the leverage needed to the economy to take off again,” said Sfeir, who is also chief executive officer of Bank of Beirut.

One of the world’s most heavily indebted states, Lebanon finally approved the 2019 budget on Friday, aiming to cut the deficit as part of efforts to put the public finances on a sustainable path.

The government embarked on long-delayed reforms as the economy stagnated and as deposit growth in the banking sector slowed: the sector has long played a critical role in financing the state and the wider needs of the economy.

“There was plenty of worry in the air,” Sfeir said, linking these concerns to political friction over the budget. “The worry was manifested in depositors asking for more interest on their holdings, or some withdrawal of deposits,” he said.

“But for the last 48 hours, I feel that the markets are more quiet, people are more quiet, transfers from Lebanese pounds to U.S. dollars are less than normal.”

The budget aims to bring the deficit down to some 7.6% of GDP from more than 11% in 2018, though the International Monetary Fund has said this year’s deficit is likely to be well above the targeted level.

“The deficit that was reached is acceptable by Lebanese standards, if not by international standards. But the effort is appreciable. So the more our depositors feel optimistic, the more we will be seeing a higher inflow of capital,” Sfeir said.

FOREX RESERVES BOOSTED

With Lebanon’s foreign currency reserves falling, Lebanese banks recently launched a new effort to draw in fresh dollars by offering interest rates of 14% on large sums locked up for three years. The dollars are deposited at the central bank.

“I was told that almost $800 million to $1 billion was injected in those products. The significance of that is positive, certainly. It is an additional $1 billion into the reserves, although expensive, but here they are,” Sfeir said.

The average interest rate paid on deposits in Lebanon climbed to around 6.8% this year from 3.4% to 3.5% last year, he added, saying that while these rates were on the high side, they were in line with those offered in the regional market.

He said loans had also shrunk in the five months period to the end of May by almost 5%.

Ratings agencies S&P and Fitch are both expected in Lebanon soon. Sfeir said he hoped they would wait for the 2020 budget before taking any new action on Lebanon’s sovereign ratings.

“We hope they will be understanding enough to be patient and to assess the situation ... based on the 2020 budget. The 2019 budget is a good step further, and we expect a substantial effort to reduce the deficit in the 2020 budget,” he said.

Source: Reuters