Decades of mismanagement and systemic corruption drove Lebanon into the worst economic crisis. The Central Bank of Lebanon played a pivotal role in the decline of the country.

By Mohammad Ibrahim Fheili

Decades of mismanagement and systemic corruption drove Lebanon into the worst economic crisis. The deliberate failure of the ruling parties to adopt, legislate and implement the necessary reforms has poured oil onto the fire of the crisis that is raging across all of the productive and vital sectors of the domestic economy.

If you are a Lebanese living in Lebanon, you have so many normals to return to, and Covid 19 is the least of your worries! The corrupt political class destroyed much of what Lebanon has, and continues to do so irresponsibly.

Will Lebanese ever be able to reclaim their beloved nation? The bankrupted government swallowed the nation’s pool of savings rendering the banking sector, households, businesses and the central bank of Lebanon (known as BdL – Banque du Liban) victims of its evil deeds with little hope for recovery.

Bank deposits

Will bank deposits be ever released back to its rightful owners? The Governor of BdL gave up on Central Bank Independence, and lost his immunity from political contamination in return for professional longevity. That made it so easy for the corrupt and incompetent of the political class ruling the nation to turn people’s attention away from them and point the finger at him.

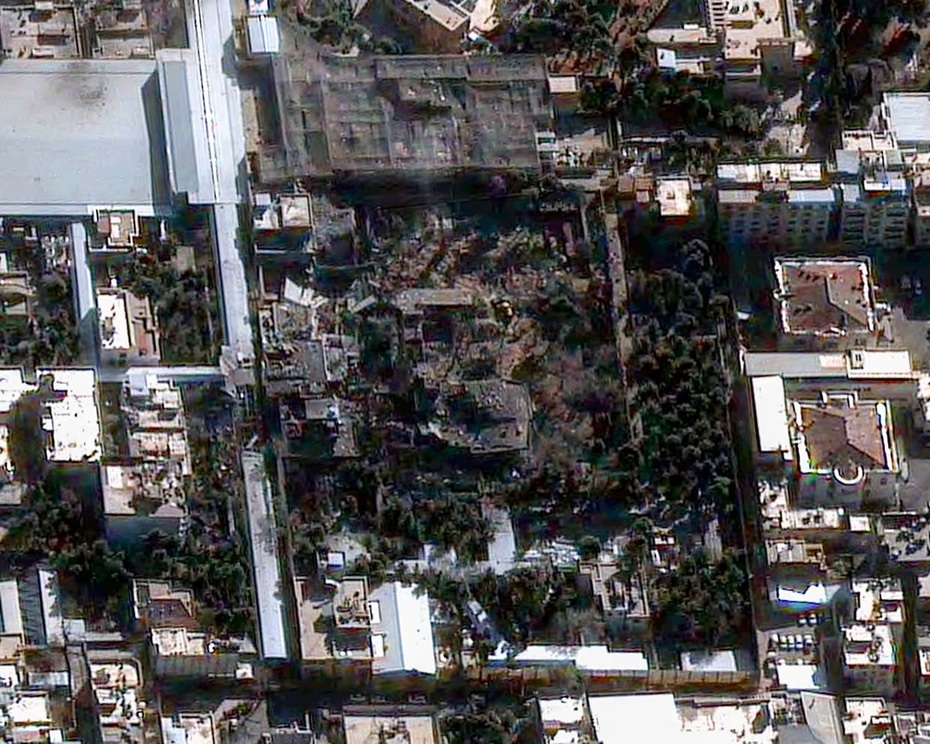

Bank Governor Riad Salameh spent decades enjoying fame; however, nowadays, he is only weathering the blame and shame. Will he ever walk away from it all? Last but not least, the August 4th explosion brought the once resilient capital of the MENA region down to its knees begging for help. Will Beirut ever be able to reclaim its glory? The list is endless in fact!

No wonder why people in Lebanon pay little attention to Covid 19 safety instructions and guidance. We have been trying to weather one crisis after another, and all have been derivatives of the lack of conduct by the political class, and the politically driven conduct of the monetary authority.

Despite all that, I strongly believe that there is hope if we turn to the private sector for a genuine rescue and a true recovery plan. At the time when the government was firmly holding on to its unstructured policy of subsidizing imports (instead of pumping fresh capital into domestic industry); and it did that not from its own resources since there is little to none left, but by using and abusing what is left of foreign currency reserves at BdL,

This is not to downplay the importance of what needs to be done by the government to secure full recovery and help the Lebanese economy move toward sustainable economic growth.

Moving forward

However, it is time we move forward, and give up on just waiting for any good to come from the corrupt and incompetent political class. The pathway to this has to be through the banking system. I know many of you blame banks for contributing to the pains you are in today, but that does not make their role in an economic recovery any less important.

I am talking about banks not bankers! In a free market economy, banks are the providers of essential services to households, firms and governments, and the markets more broadly, and they play a critical role in holding the economy on its own feet in good and bad times.

Regulators around the globe understood the challenges and have already relaxed much of the rules that could bind banks from serving their economic roles. Of these recently instituted rules: banks can fully use their capital and liquidity buffers to assist in the economic rescue efforts.

That is, banks can operate below the level of capital defined by the Basel Committee on Banking Supervision (BCBS) if and when needed to help their clients cope with the crisis - regulatory compliance deprioritized. Upholding banks’ capital adequacy cannot be a priority in times of emerging and escalating crisis; a message the monetary policy authorities of Lebanon chose to ignore!

The goals of monetary policy are controlling inflation, managing employment levels, and maintaining long-term interest rates. That is, providing environment conducive to financial stability and economic growth.

The “conductor” of monetary policies – the Central Bank, implements its policies, in coordination with the government but independent of political contamination and away from feeding into and/or encouraging fiscal irresponsibility, through open market operations, reserve requirements, discount rates, the overnight rate of interest, and inflation targeting. In no place monetary policy makers directly target and/or address the clients of financial institutions except in Lebanon.

Ever since the crisis erupted in Lebanon in late 2019, BdL circulars address banking clients, and are circulated and read, interpreted and misinterpreted by the public at large before financial institutions have gotten a chance to understand them and allocate resources for their implementations.

The lack of confidence in the Lebanese financial system, banks and central bank, have pushed citizens to doubt policy makers’ intentions which often translate into fierce confrontations between banks and their respective clients. Such outcomes turned BdL Circulars into disrupters and time-consuming instead of serving as welcomed guidance to the work of financial institutions.

The developing crises in Lebanon call for loose monetary policies, less guidelines to follow and to comply with; that is, let financial intermediaries do what they do best. Much support and freedom must be provided to banks to allocate more resources to cope with the evolving crisis and its implications, and to bail out distressed clients.

With resources running short here in Lebanon, policy makers must not treat financial institutions as equal; instead, they must discriminate between them on the basis of their capacity to serve. That is, provide support for banks that have and choose to use their capital and liquidity buffers to lend and undertake other supportive actions in a safe and sound manner.

Any measures which can enhance banks’ capacity to continue to serve households and businesses must be embraced by the regulatory authorities. Unfortunately, this has been nothing more than a wishful thinking since most BdL circulars have been forcing banks to deploy excessive quantity of the scarce resources in pure administrative tasks which are at best draining more resources, and serving no purpose in rescue nor in recovery efforts!

A no stranger to what central bankers around the globe have done in times of crises, the Governor of BdL, pressured by corrupt politicians and bound by limited resources which have been drained by utter incompetence, embarked on a number of actions with, in retrospect, ill-defined outcomes!

Judging by these outcomes, the central bank has been hypothesizing about the root-cause of the crisis, prescribing solutions and undertaking measures that don’t amount to more than mere reactions which at best shift household attentions away from political misconducts to all-out confrontations with their respective banks.

Subsequently, the ruling political parties get a break at the expense of depositors first and far most, and the economy at large. Almost an unchallenged fact, the domestic economy dove deeper into the crisis with every BdL circular.

Business disrupters

In fact, those circulars don’t amount to more than just “business disrupters”. The Lebanese economy has been managed, or better yet, mismanaged by BdL Circulars and guidelines while the fiscal authority has been in a state of absenteeism from the economic scene!

The monetary authorities have been treating banks indiscriminately assuming that they all share the same strengths and weaknesses, while the reality is that there is nothing but the crisis which banks operating in Lebanon have in common. Banks do not share the same:

In short, banks do not share the same exposures, nor the same risks and/or compliance culture. Therefore, they can’t be treated equally, nor should they be protected like endangered species.

There is no “one set of regulations” that fits all banks! The monetary authorities must act decisively to support the banks which have a proven capacity to weather the financial storm, and put an end to others that have been draining resources unnecessarily.

Capable banks need to move swiftly to identify which customer segments are in most imminent danger and quickly, and in real time, analyze and monitor data for early warning signals. That exercise allows banks to build a comprehensive view of the economic landscape as they wait for the crises to recede.

In addition, such a performance will mark a much-needed step in the journey to restore the lost trust and confidence between the bank and its clients.

The sharp economic slowdown, and the equally sudden interruption to core banking functions posed a legitimate threat to banks’ ability to effectively help delinquent customers; a true economic risk!

Most banks have appropriately acted to try and contain virus spread and protect their employees’ and customers’ health. Albeit necessary, it is not sufficient. Each bank must’ve done the assessment for its own clients since there can’t be a one-size-fit-all remedy! The severity of the crises is likely to lead to larger-than-expected drawings on credit lines. Can banks in Lebanon deliver? Unfortunately, little we know, so far, about the answer to this question!

Finally, despite the good intentions behind the actions of BdL, under the leadership of Governor Riad Salameh, they all have been driven by the need to provide a diversion and a cover for the failure of the political class to act to soften the impact of the fast-mounting economic pains.

All what is required of policy makers is to introduce measures that strengthen banks, and banks will sure deliver. Banks play a vital role in the functioning of the economy. Their health, and that of their workforce, the continuity of their operations, and their safety and soundness are therefore critical.

That should be at the heart of every decision and measure policy makers (on the fiscal and monetary fronts) produce free of any political ill-will or motives for self-gains. I am confident that banks have learned their lessons though late; however, the governor of BdL continues to be overwhelmed with weathering the mounting blames, and rescuing the ailing ruling class.

The whole nation has been bearing the burden of Salameh’s journey from fame to shame!

Mohammad Ibrahim Fheili is a Lebanese Banker and Risk Strategist & Capacity Building Expert. He has over 30 experience in the Levant region. This is his second contribution to the Levant News.