In 1970 Germany and the Soviet Union gathered at the luxurious Hotel Kaiserhof in the German city of Essen. The signing of a contract for the first major Russia-Germany gas pipeline was celebrated, which was to run from Siberia to the West German border at Marktredwitz in Bavaria. That was the start of Europe’s gas dependency, which is now blowing up in the European Union’s (EU) face with extremely high energy prices. How did the European countries get there?

By Arthur Blok & Nikola Mikovic

Energy prices are sky-high on the European continent. Households, small and medium-sized enterprises (SMEs), and numerous cities fear the winter. Strict energy-saving rules are being introduced, such as cutting off the hot water in public buildings and sports halls, switching off public fountains, and stopping significant illuminating buildings. At the same time, consumers and SMEs are begging governments for compensation.

More drastic measures are under consideration in the EU, including gas rationing for energy-intensive industries. Measures part of an EU-wide Gas Demand Reduction Plan, ominously titled Save Gas for a Safe Winter, to reduce gas use in Europe by 15% until next spring. Among the proposals is a provision that officials in Brussels impose fines for non-compliance if they decide the crisis is escalating dangerously.

What happened, and why was this crisis not anticipated?

In a blind effort to become more sustainable and reduce CO2 emissions, most European countries in the past decennia rapidly closed coal-fired and nuclear plants while simultaneously investing in renewables like solar and wind energy. An ambitious energy transition that needs many more years to come into effect.

Let’s forget coal-fired power plants for a minute; why would governments, which regarded climate change as their top energy priority, close atomic plants before the end of their useful lives? Does that even make sense?

In practice, the EU countries were shooting themselves in the foot. Decreasing local production resulted in the growing demand for foreign resources, which meant a sharp increase in large quantities of - relatively cheap - Russian gas.

Ironically, politicians who want to be seen as environmentalists are increasing greenhouse-gas emissions by forcing the premature closing of serviceable nuclear-power plants and burning natural gas instead. Meanwhile, the Ukraine war has forced the EU to speed up the process of energy decoupling from Russia and look for an alternative to Russian gas.

But will it succeed?

Kremlin

Despite pro-Kremlin apocalyptic announcements, Europe will unlikely “freeze to death” this winter without Russian gas. These “sustainable policies” in European countries will undoubtedly face immense problems, but Russia, rather than Europe, could get the short end of the stick in the long term.

Many underground gas storages all over the continent are already 80 percent full, and the EU is trying to secure gas and oil supplies from other producers. For instance, France seeks to replace Russian oil with energy from the United Arab Emirates. In July, a deal between French energy giant Total and UAE state oil company ADNOC was signed “for cooperation in energy supplies.

Speculations suggest that, in case of a massive energy crisis, Europe could import the de facto Russian natural gas not directly from Russia’s energy giant Gazprom but China. This scenario is possible given that Ukraine has been implementing the same “strategy” for years.

In November 2015, Kyiv stopped buying Russian gas. Or, more precisely, it stopped buying it directly from Russia. Officially, Ukraine increased purchases from Europe instead, but in reality, a significant volume of it still comes from Russia.

Natural gas has been delivered to Ukraine from the EU via virtual reverse – mostly from Slovakia – while Kyiv remains a consumer of Russian gas, buying it from European partners at an inflated price and receiving it from its transit volumes.

The coming months will show if the EU will use China, or some other country, as a “virtual reverse.” One thing is for sure – for Russia, Europe remains the primary market for its energy exports. To this day, despite the war in Ukraine, Russia continues selling gas to Europe via the territory of the former Soviet republic.

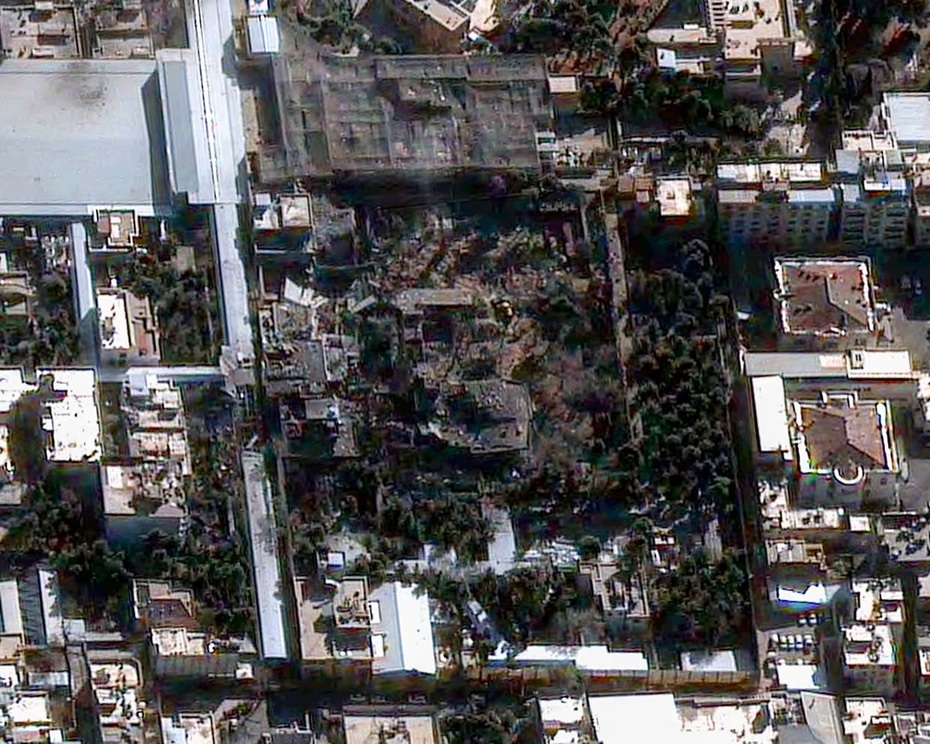

After the recent Nord Stream pipeline explosions, the Druzba pipeline – passing through Ukraine and TurkStream – connecting Russia and Turkey via the Black Sea – remains the only two routes that Moscow uses to supply Europe with natural resources and gas.

As the late United States, Senator John McCain once said, “Russia is a gas station masquerading as a country.” Thus, it is not very probable that Moscow will halt gas and oil supplies to the European Union, no matter what happens.

Still, while the European Commission aims to impose a price cap on Russian gas, several EU members fear such a move would force the Kremlin to halt all gas flows to Europe. But given that Russia has already made numerous “goodwill gestures” and unilateral concessions to its Western partners, it is not improbable that Moscow would continue selling gas to Europe even if Brussels limits the price.

The problem for Europe, however, is that it will unlikely be able to end its dependence on Russian energy quickly. The “gas divorce” is expected to be painful for some EU members, partially due to Brussels’ decades-old failed energy policy.

Until other producers replace Russia as the major European gas supplier, “the old continent” will almost certainly have to adapt to a new reality in which blackouts could become a norm. On the other hand, it will take years before Russia diverts its energy exports from Europe to Asia, which means that, in the meantime, the country’s energy giant Gazprom will not be able to count on significant export income from the European market.

Therefore, in the short term, Europe and Russia will unlikely be able to break their energy interdependence, but at a cost. In the long run, the future of energy supplies in Europe will likely depend on the outcome and aftermath of the Ukraine war. A conflict that could completely transform the current global energy order with far going consequences for the European consumer.